First, a quick primer: non-fungible tokens, or NFTs, are unique tokens stored on a blockchain, which is a form of digital ledger, and they cannot be modified or replaced with another token. NFTs are unique, like a one-of-a-kind trading card, and are traded between users on a public blockchain. Common types of NFTs include digital files such as artworks, and video or audio recordings, but they can represent much more.

How do NFTs work?

Traditional works of art such as paintings are valuable precisely because they are one of a kind, whereas digital files can be easily and endlessly duplicated. While this doesn’t really change with NFTs (they just provide proof of ownership), with NFTs artwork can be “tokenized” to create a digital certificate of ownership that can then be bought and sold.

A GIF, for example, can then go for hundreds of thousands of dollars with the right marketing. Most NFTs will be sold for pennies, but some can go for extremely high amounts. The most expensive NFT so far is a digital collage of images that sold for nearly US$70 million last year.

However, you may not want to get too excited just yet, as such riches are by no means guaranteed. Indeed, it’s usually the founders of the platforms used who are the real winners. Marketplaces such as OpenSea (which is like the eBay of the NFT world) have exploded in popularity and despite the apparently waning interest in NFTs as digital collectibles, many think the market will still grow exponentially over the next decade.

What are the risks?

In the online world, one perennial risk to be aware of is cybercrime. One thing cybercriminals are excellent at is adapting quickly to a new-found technology or trend, before the public is fully educated in what it is getting involved in. As NFT sales happen virtually, are subject to zero regulation, and all marketing is done via social media, it’s easy to get scammed or at least to see scammers trying to take advantage. Popular NFT communities commonly hire influencers and celebrities to promote the assets, making it difficult to know which ones are fake.

RELATED READING: 4 common ways scammers use celebrity names to lure victims

If you fancy buying NFTs, you need a cryptocurrency wallet or an account with an exchange like Binance or Coinbase – most marketplaces currently use the Ethereum blockchain to power their transactions. Once ready, all you do is choose the marketplace you want to buy the NFT from and browse it to choose an item of your liking. Most marketplaces have an auction system set up, where you will need to bid for the NFT you want, but sometimes there will be a ‛buy now’ price – again, similar to eBay.

A lot of NFTs are actually acquired for the fun of it, but many are bought with other good intentions or as an investment. The NFT market is a speculative market driven by scarcity and the fear of missing out (FOMO) that often drives up demand, but this can have a spiral effect when things go wrong and leave people losing out. The Bored Ape Yacht Club has made NFTs a rather strange commodity and its heyday also largely coincided with the rise to prominence of NFTs as such.

The future is potentially looking very interesting, though, as NFTs could be a framework of a new digital economy, at least according to NFT advocates. Smart contracts, which power NFTs, are hardcoded on the blockchain, meaning people can have confidence when purchasing one. Think digital art. In the near future, artists might have better control over their own artwork and could sell their art in digital form, which will make them super easy to control and sell their works at a price they think is right.

RELATED READING: When NFT Is the Creative Limit

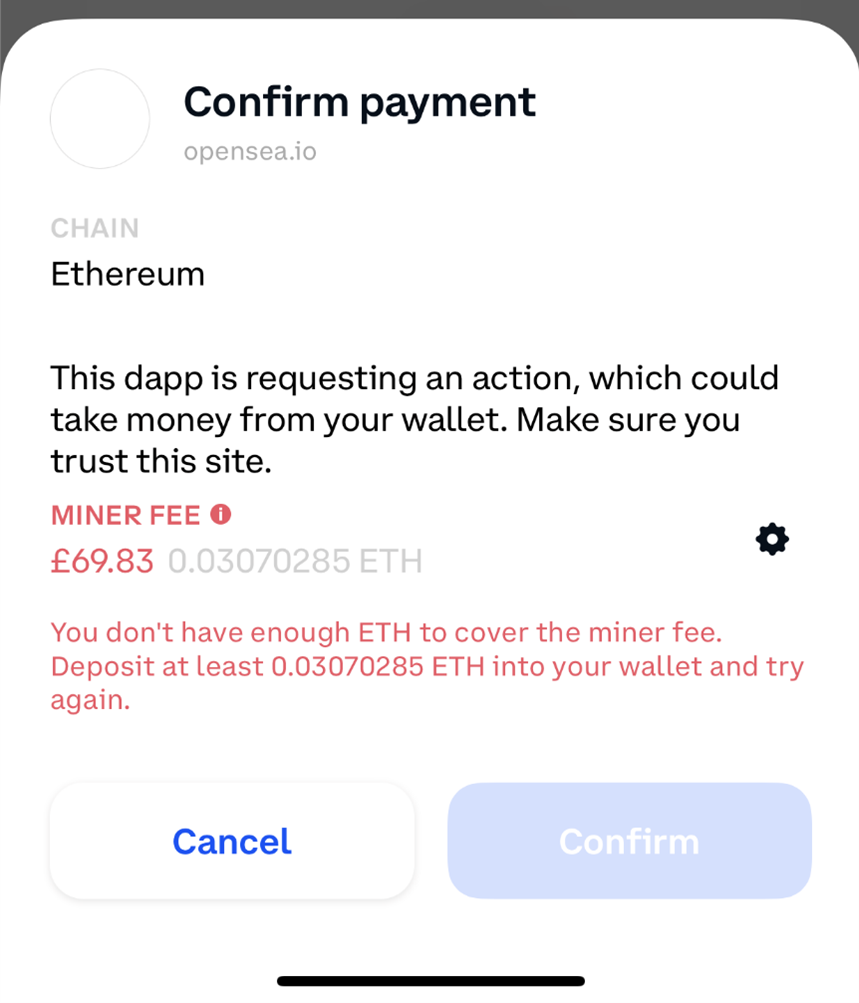

On the other hand, the fees in the NFT space can often outweigh the return, so my first tip would be to look at the fees in great depth, which are often difficult to understand or even misleading. You will be charged for buying your initial cryptocurrency (if you don’t already own some), exchanging coins, listing the NFT, and then also charged for purchasing one.

All this fuss – how easy is it to do?

Due to the hype over the last year around NFTs, I thought there is no better way to fully understand it than by making my own. NFTs can be anything from a short media file, a PNG, a GIF, or even a tweet, and are sold for whatever someone is willing to pay for it. Being a dad and a lover of bad dancing, I thought what better than to make a moving GIF of my dad-dancing moves and attempt to sell it for millions!

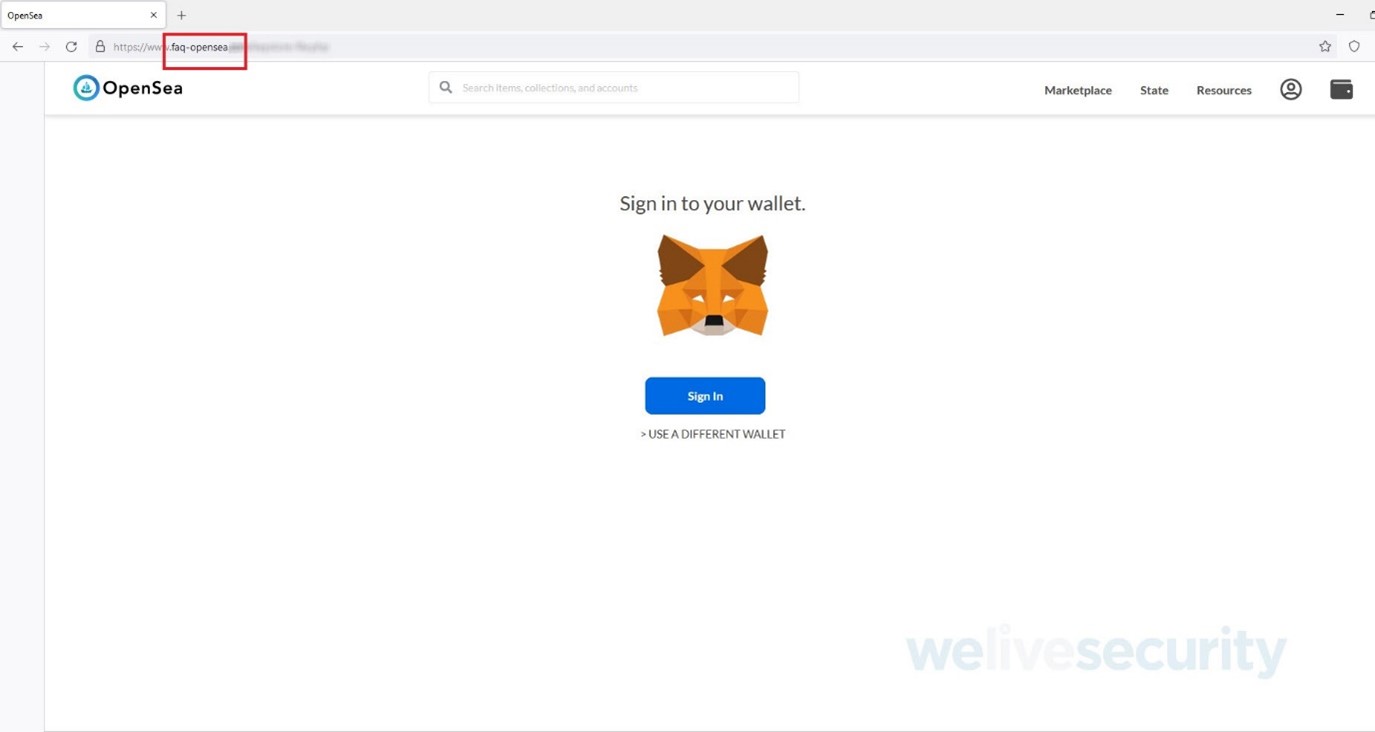

With my GIF now ready, I created an account on OpenSea and got right to it where I could sell my NFT. I decided to sell my NFT without a limit in a timed auction and starting at $2 and hoped for the millions of bids to roll in.

Fees

The fees to simply place an NFT online are likely to outweigh the potential profits, which needs to be carefully considered. There are fees incurred every time you exchange your money and this needs to be done at least twice. These fees hit when you change from your currency to a digital currency but then it needs to be turned into ETH. To place your NFT in an auction you need to pay for this, but you’ll need to pay miner fees to cover this exchange. However, I placed my GIF online and took the plunge hoping it would be a success, but I was wanting to test the procedure rather than make money.

The interesting part of the experiment is that I was actually able to sell my NFT. When I received the email stating it had sold, I was excited to see what I had sold it for. In my mind, I was already purchasing a yacht but that all came crashing down when I only sold it for $2. It hurt even more when I realized I had spent over $20, including fees, in setting up this experiment – this was still substantially less than the miner fee OpenSea initially wanted to charge me (Figure 2).

Figure 2. Before it fell to a much lower level, the miner fee was far higher than I was willing to accept

Scams

Unfortunately, cybercriminals follow trends and are never too far behind new technology and looking for a chance to fleece people. Here are two of the most common NFT scams:

Phishing

Phishing can happen via email or in Twitter messages, so you have at all times to have your wits about you and err on the side of caution.

When you set up a cryptocurrency wallet, you should receive a seed phrase. Your seed phrase is a list of words (usually ranging from 12-24 words) that can be used to recover access to your cryptocurrency wallet should you forget your password. As a rule of thumb, you will only need your seed phrase when creating a hardware backup of your cryptocurrency wallet or when recovering your wallet, but scammers may attempt to phish this from you, often via email or social media messages, and take you to imposter websites.

Therefore, always go directly to the verified website for any cryptocurrency transactions and never use unverified links, pop-ups, or your email to enter your information. When you first receive your seed phrase, write it down on paper, store it somewhere very safe, like a safe deposit box, and never give it out to anyone – don’t even store a photo of it in your phone.

Pump-and-dump schemes

Pump-and-dump schemes are becoming somewhat predictable in the cryptocurrency and NFT worlds. The term refers to when a group of people buy lots of NFTs or currency and artificially drive demand way up (like eBay users hiking up demand). Once they are successful, the scammers cash out when prices are high, leaving those who weren’t in on it behind with worthless assets.

RELATED READING: The flip side of the coin: Why crypto is catnip for criminals

Protecting your NFTs

Here are five general tips to help keep you safe:

- Make sure your private keys or seed phrases to access your crypto assets remain truly private – don’t ever share them with anyone.

- If you ever receive a direct message from someone who claims to be a founder, celebrity or influencer, don’t respond to it or click on links. Sadly, this is how a lot of the scams start.

- Should you still want to buy an NFT, I recommend you do your research to make sure you buy the item from a verified account. It’s not a bad idea to look for the blue verification tick next to the artist’s profile on the NFT marketplace, although it’s by no means a guarantee of the account’s legitimacy.

- If you buy an NFT, try to also take possession of the tangible or digital asset (in the form of a JPEG, MP3, or PDF file) outright. This isn’t always possible, but it helps with the confidence of what you are buying is genuine. New scams are always storming the NFT scene, which is why you can’t go it alone.

- The best way to avoid new and existing NFT scams is to stay informed and do your research.

So what is the good news?

Proponents and early investors claim that NFT marketplaces mark the framework of a new digital economy and there are lots of people who are getting excited about the future of this technology. The FOMO that some feel is wild, and this is obvious when low-res comic images of apes, memes, or even NFTs for “land” in the metaverse can go for thousands of dollars.

We are potentially in an evolution and there is always money to be made in a true evolution. But NFTs are speculation, or even just a guess with no real evidence. The journey is interesting nonetheless, and I am looking forward to seeing where it goes – if only because it throws the spotlight on technological innovations and progress as such. Just remember to be careful and stay protected!

FURTHER READING: Common NFT scams and how to avoid them